To find good businesses at attractive valuations, our investment team conducts fundamental research. As demonstrated above, this research is based on a well-defined and repeatable process, and is guided by our investment philosophy. We believe that this approach to investing is capable of generating consistent investment returns over the long term through the power of compounding.

MARGIN OF SAFETY

We believe a margin of safety exists when we are able to mitigate both business risk (our business, financial and management criteria have been met; sustainable competitive advantages exist) and price risk (when we believe there is a significant discount to intrinsic value at the time of purchase — we aim to purchase at 75% of our estimate to intrinsic value or less).

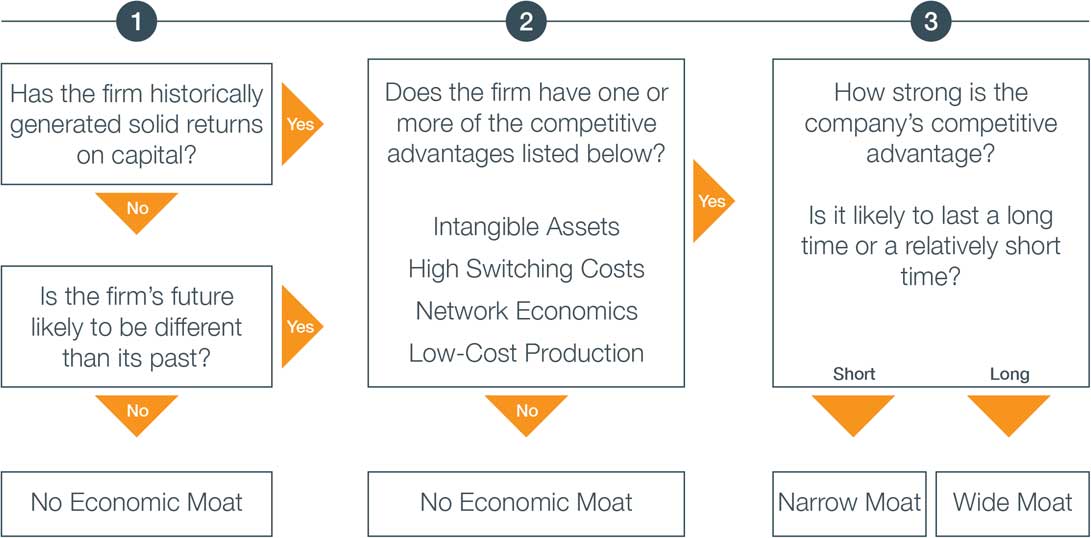

Moats Analysis